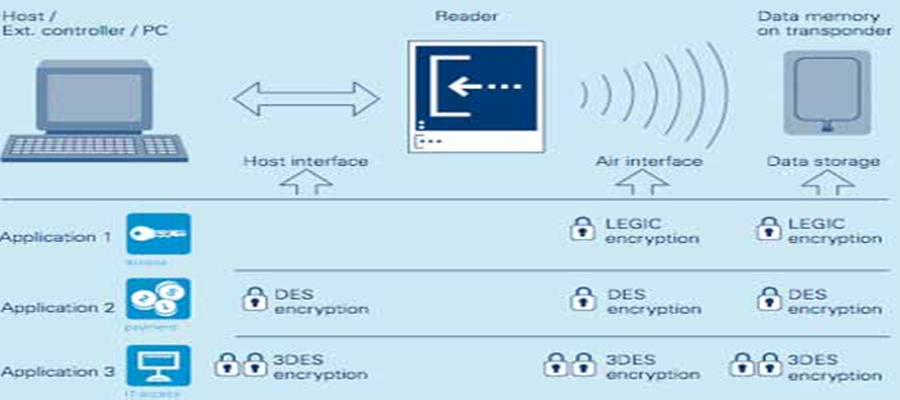

A contactless smart card includes an embedded smart card secure micro-controller or equivalent intelligence, internal memory and a small antenna and communicates with a reader through a contactless radio frequency (RF) interface. Contactless smart card technology is used in applications that need to protect personal information and/or deliver fast, secure transactions, such as transit fare payment cards, government and corporate identification cards, documents such as electronic passports and visas, and financial payment cards. Example applications using contactless smart card technology include:

- The U.S. FIPS 201 Personal Identity Verification (PIV) card being issued by all Federal agencies for employees and contractors;

- The Transportation Worker Identification Credential (TWIC) being issued by the Transportation Security Administration;

- The First Responder Authentication Card (FRAC) being issued in Department of Homeland Security pilots;

- The new U.S. ePassport being issued by the Department of State;

- Contactless payment cards and devices being issued by American Express, Discover, MasterCard and Visa

- Contactless transit fare payment systems currently operating or being installed in such cities as Washington, DC, Chicago, Boston, Atlanta, San Francisco and Los Angeles.

Contactless smart card have the ability to securely manage, store and provide access to data on the card, perform on-card functions (e.g., encryption and mutual authentication) and interact intelligently with a contactless smart card reader. Contactless smart card technology and applications conform to international standards (ISO/IEC 14443 and ISO/IEC 7816). Contactless smart card technology is available in a variety of forms – in plastic cards, watches, key fobs, documents and other handheld devices (e.g., built into mobile phones).

A contactless smart card is a contactless 13.56-MHz credential whose dimensions are credit-card size. Examples of cards adhering to these standards include ATM cards, bank cards (credit and debit cards including VISA, MasterCard, American Express, etc), telephone cards, gift cards, loyalty cards, driver’s licenses, membership cards, food stamps cards, and nearly any application in which value or secure information is not stored on the card itself.